Despite a tumultuous economic climate, Nigeria’s non-pension asset management industry experienced remarkable growth in 2024, with total assets under management (AuM) increasing by 71.2 per cent to reach N10.1 trillion.

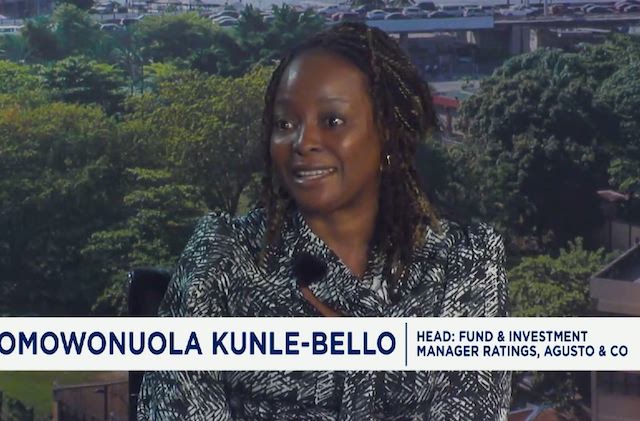

According to a report by Agusto & Co., this growth was driven by macro-economic factors, regulatory reforms, and heightened investor engagement, particularly from the retail segment.

“In a year defined by significant macroeconomic instability and soaring inflation, Nigeria’s non-pension asset management industry did not just survive; it thrived, spectacularly. Total assets under management increased by 71.2 per cent to reach an aggregate of N10.1 trillion.

“This considerable expansion was underpinned by a confluence of macroeconomic factors, regulatory reforms, and heightened investor engagement, particularly from the retail segment. The proliferation of digital investment platforms prised open market access for a new generation of younger, digitally-native investors, democratising access to wealth creation like never before,” Agusto & Co. said.

However, the report noted that the sustainability of this growth is uncertain, as it appears to be predicated on volatile economic conditions.

It stated, “The industry’s growth was largely driven by investors seeking safe havens from inflation and currency fluctuations.”

The report also highlighted the dominance of segregated portfolios, which accounted for 57 per cent of the total AuM. According to Agusto & Co., Collective Investment Schemes (CISs) also saw significant growth, with AuM increasing by 82 per cent to reach N3.74 trillion.

“The top five asset managers control 55.5 per cent of total AuM, with Stanbic IBTC Asset Management maintaining its position as the market leader. However, newer players such as CardinalStone and Norrenberger are starting to challenge the dominance of the established players.

“While the industry map is expanding, power remains concentrated. Segregated portfolios (which include managed discretionary and non-discretionary client funds not publicly disclosed) maintained their dominant position within the industry. Serving as customised investment vehicles tailored specifically for institutional clients and high-net-worth individuals, these bespoke portfolios accounted for 57 per cent of total AuM.

“These mandates offer the kind of customisation that large-scale capital demands. However, the real momentum was in Collective Investment Schemes. Here, AuM skyrocketed by 82 per cent to reach N3.74 trillion, with 29 new funds entering the fray,” the report said.

It added, “The sheer variety of new launches – spanning money market, dollar, balanced, and Shariah-compliant funds – speaks to a market scrambling to meet a growing public demand for diversification, liquidity, and ethical options.

“Yet, for all the talk of dynamism, it remains a game of giants. The top five asset managers still control a commanding 55.5 per cent of total AuM, expertly leveraging their affiliations with banking behemoths to dominate distribution channels.

“Stanbic IBTC Asset Management held its position as the undisputed market leader. But the landscape is not entirely static. Ambitious players like CardinalStone and Norrenberger have started chipping away at the dominance of the old guard, suggesting that a more dynamic competitive environment is emerging.

“In 2024, the macroeconomic backdrop continued to be shaped by the impact of policy reforms enacted in 2023: the liberalisation of the naira and the removal of petrol subsidies. Intended to stabilise the economy, these policies instead unleashed a torrent of inflation, which averaged a staggering 31.7 per cent in 2024. The Central Bank of Nigeria (CBN) fought back, hiking its policy rate by a massive 875 basis points to 27.5 per cent.”

The report forecasts continued growth in the industry, with a 60-65 per cent rise in AuM expected, potentially pushing the industry beyond the N16 trillion mark within a year.

“Looking forward, Agusto & Co. forecasts continued expansion of the Nigerian asset management industry, with a 60–65 per cent rise in AuM, potentially pushing the industry beyond the N16 trillion mark within a year.

“Heightened product awareness, increased institutional participation, and sustained retail investment momentum, particularly via fintech collaborations, will be the primary engines. Nevertheless, the industry’s fate remains tethered to the nation’s economic health.

“Persistent inflation, currency risk, and immense fiscal pressures are headwinds that could easily stall the current trajectory. The path to N16 trillion seems paved, but it is fraught with the very same macroeconomic risks that fuelled the initial scramble for returns. The question for Nigeria’s asset managers is no longer if they can grow, but if they can build lasting value on such volatile ground,” it stated.